Western Hemisphere: Senior State Department Official On Title III of the LIBERTAD Act

03/04/2019 01:05 PM EST

Special Briefing

Via Teleconference

March 4, 2019

MODERATOR: Thank you, and good morning everyone, or good afternoon. Thank you for joining us for today’s background briefing on the LIBERTAD Act, also known as the Helms-Burton Act. Today with us is [Senior State Department Official]. A reminder: Today’s call is on background and will be embargoed until the end of the call. I’ll now turn it over to our senior official for brief remarks and then we’ll take some questions. Thank you.

SENIOR STATE DEPARTMENT OFFICIAL: Great. Thank you very much, and thanks to everyone for joining us. I know there’s a lot of interest out there, and so I am pleased to discuss today Secretary Pompeo’s historic determination regarding Title III of the LIBERTAD Act. As you know, the United States is committed to advancing human rights, democracy, and the rule of law in Cuba. This administration’s policy towards Cuba in particular has been especially clear-eyed in its focus on improving human rights, encouraging the rule of law, fostering free markets and free enterprise, and of course, promoting democracy and freedom in Cuba.

We, of course, are extremely concerned about ongoing human rights abuses in Cuba. The regime continues to deprive the Cuban people of fundamental freedoms, including freedom of speech, the press, and assembly. It’s demonstrated over and over again that it’s willing to use force to silence dissent. Reputable NGOs have reported more than a hundred political prisoners are behind bars, and most recently we saw the regime in action in the violent crackdown on opposition figures that took place prior to the February 24th so-called constitutional referendum.

Unfortunately, even under a new president in Cuba, nothing has changed. We see that the constitution retains the same authoritarian political system and simply reinforces the communist party’s control over the island. Cuba continues to maintain close relations with Russia and China and has destabilized Venezuela, leading to mass flows of refugees and, of course, public health threats.

Since the LIBERTAD Act came into effect in 1996, as you are aware, every administration has fully suspended Title III. But despite that, we continue to see the Cuban state’s repression of its own people, which has, in our view, persisted and even worsened. We have seen additional reputable NGOs report over 2,873 short-term arrests in 2018 and over 405 arbitrary detentions in February 2019 alone. Accordingly, this administration undertook a very serious and thorough review of Title III, the conditions on the ground in Cuba, and whether a waiver is both in the U.S. national interest as well as expedite the transition to democracy.

So based on those considerations, Secretary Pompeo has decided against fully suspending Title III at this time. So today he is announcing the suspension of Title III for 30 days. That’s a period from March 19th to April 17th. But there is one crucial exception, which is that U.S. nationals will have the right to bring action against Cuban entities and Cuban sub-entities on the Cuba Restricted List. And as a reminder, the Cuba Restricted List identifies entities and sub-entities under the control of Cuban military intelligence or security forces, which are, of course, those that are directly responsible for the repression of the Cuban people.

So finally, with this decision the U.S. is holding the Cuban regime accountable and opening a path of redress for U.S. claimants whose property was illegally and unjustly seized by the regime. We should remember that after Fidel Castro seized power, he confiscated private property of thousands of private individuals and companies without any compensation. And to date, there’s really been no justice for this theft. In 1996, when Congress passed and the president signed the LIBERTAD Act, that was partially to penalize those who benefit from the rightful property of Americans.

In addition to taking this action, we also are continuing to encourage the international community to press Cuba on human rights and demand that the regime stop harassing and detaining peaceful activists and independent journalists, release political prisoners, and provide for a democratic and prosperous future for the Cuban people. We’re also encouraging anyone doing business in Cuba to consider, whether intentionally or not, they’re trafficking in confiscated property and therefore abetting the regime’s repression.

So in sum, this is – it’s clear that by this action we are ratcheting up pressure on the Cuban Government. In the days ahead we’re going to continue to monitor the impact of the suspension with an exception and assess what further action may be necessary to the national interests of the United States and to expedite democracy and support efforts by the Cuban people to bring reform to their country. We’ll also continue to encourage international partners to hold Cuba accountable for propping up the Maduro regime in Venezuela and press them to stop harassing and detaining peaceful activists and independent journalists.

And with that, I’ll close and happy to take any questions.

MODERATOR: Okay. Now we’ll move over to the questions.

OPERATOR: Ladies and gentlemen, as a reminder, please press * then 1 if you would like to ask a question.

All right. We have a question. We have a couple people in queue for a question.

MODERATOR: Okay. We’ll take the first question.

OPERATOR: All right. We’ll go to the line of Matthew Lee from AP. Please, go ahead.

QUESTION: Thanks. Listen, I’ve read through this waiver, which is very short, and I’m having a hard time figuring out exactly how – what kind of pressure this is going to put on the Cubans. And to that – to that end, how is a U.S. company or person supposed to bring an action against these people? What courts?

And secondly, are – if there are joint ventures that are on the list of restricted entities and sub-entities, will the foreign partner in the joint venture be able to be sued as well? Thank you.

SENIOR STATE DEPARTMENT OFFICIAL: Yes, thank you very much. So I’ll take those three questions in order.

So in terms of the type of pressure, so, of course, this is the first time that we are implementing –that we have an exception to the waiver for Title III. It’s very clear through this action that we are going to hold the Cuban regime accountable for its confiscation of properties and ensure that there is justice for U.S. claimants.

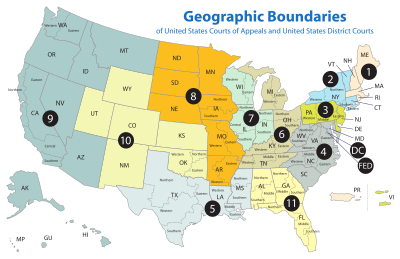

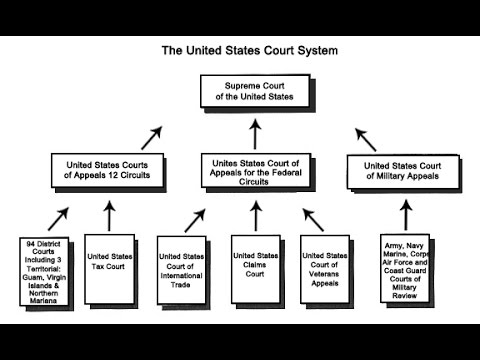

With respect to where they bring these cases, that would be to the U.S. federal courts.

And then finally, this is with a specific focus on Cuban entities and sub-entities, so as it currently stands, the intention of the Secretary’s decision is for them to be the – those against whom action is taken, not those who are engaged in joint ventures, at this time.

MODERATOR: Thank you. We’ll go the next question.

OPERATOR: We will now go to the line of Nick Wadhams from Bloomberg News. Please, go ahead.

QUESTION: Hi, thanks very much. Given your answer that this will not target foreign companies, can you explain a little bit how this will be anything more than a purely symbolic move?

And then second, why do you keep shortening the exemption? Routinely it was six months prior, then the most recent exemption was 45 days, and now you’ve gone to 30 days. Does this signal that you’re not going to keep issuing this exemption? Thanks.

SENIOR STATE DEPARTMENT OFFICIAL: Thank you very much. So with respect to the timeline, the Secretary has determined that 30 days is an appropriate time span at this time, during which period we will continue to assess the impact that it has had, and also in line with those two principles, which is U.S. national interest and expediting a return to democracy.

By limiting implementation of Title III to Cuban entities and sub-entities on the CRL, as mentioned, it does not allow Title III litigation against existing third-country investors in properties on the Cuba Restricted List. However, part of the shortening period is so that we can make a determination as to how this is affecting the calculus of others, and we will use this 30-day period as we used the previous 45-day period to encourage any person who is doing business in Cuba to reconsider whether they are trafficking in confiscated property. We cannot make a judgment or prejudge what the Secretary’s decision will be at the end of this 30-day period in terms of where we move from here.

MODERATOR: We’ll go to the next question, please.

OPERATOR: We will now go to the line of Juan Lopez from CNN. Please, go ahead.

QUESTION: Yes, thank you for the call. So basically, what you’re announcing today is that you’re taking another 30 days before you notify that the measures will be implemented. So it won’t be, as we thought, March 17th, 18th. It’ll be way after April. And you said not joint ventures. So who – you mentioned U.S. citizens being able to be a part of these – this process. Who can they sue if they can’t sue these joint ventures when most of those entities in Cuba that operate hotels and all other – all of these type of companies are joint ventures?

SENIOR STATE DEPARTMENT OFFICIAL: Thank you very much. So to clarify, we are saying that we are restricting the implementation of Title III to Cuban entities and sub-entities on the Cuba Restricted List. If those entities are engaged in joint ventures, it doesn’t mean that the entities in the joint ventures are not able to sue. It just means that – or not able to be sued. It just means that the suit itself is brought against the Cuban entities and sub-entities.

And with respect to the 30-day period, this basically says beginning on March – the Secretary’s decision indicates that beginning on March 19th U.S. claimants can begin bringing those suits against Cuban and – Cuban entities and Cuban sub-entities in U.S. federal courts. And then during that 30-day period – following that 30-day period, we will monitor the impact of that suspension and assess whether a further suspension is necessary to the interests of the United States.

MODERATOR: Thank you. We’ll go to the next question.

OPERATOR: Our next question comes from Beatriz Pascual from EFE. Please, go ahead.

QUESTION: Hi. I was wondering if you have talked with your European partners about this, and what is their opinion on the matter, if there has been a dialogue. And some entities – so the measure only affects Cuban entities, but I was wondering if it could affect also entities associated with those Cuban entities. Like, if you could develop a little bit on that, that would be helpful. Thank you.

SENIOR STATE DEPARTMENT OFFICIAL: Thank you very much for that question. So in terms of our allies in the EU, Canada, and elsewhere, obviously we have engaged with them. We’ve consulted with our international partners and have taken those into consideration. The Secretary was very clear that part of their concerns were a factor in his decision-making process. It is part of, of course, the U.S. national interest to assess where our partners are on this issue. We also are continuing to engage them going forward to explain this policy and to make sure that they are in the loop with respect to any future decisions that come under Title III.

With respect to the second question, you’re correct. This is only allowing action against Cuban entities and Cuban sub-entities on the CRL, and it is not intended to affect European companies that are currently doing business in Cuba.

MODERATOR: Thank you. We’ll go to the next question.

OPERATOR: Now go to the line of Karen DeYoung from Washington Post. Please, go ahead.

QUESTION: Yes, hello. I just have a couple questions. One, to – again, sorry to be so dense, but to clarify on this joint venture thing. You said if there are joint ventures, it doesn’t mean that the entities in the joint ventures are not able to be sued; it just means the suit itself is brought against the Cuban entities and sub-entities. I’m just not quite clear what that means.

And secondly, there have been some people, some claimants who have already been certified by U.S. courts as eligible to sue if and when this provision was lifted. Can you clarify that a little bit, tell me how many there are, and also if and when Cuban Americans who are now U.S. citizens will be eligible?

SENIOR STATE DEPARTMENT OFFICIAL: Thanks very much for that question. So with respect to certification, this is not limited – this decision is not limited only to certified claims, and so you may be aware that there’s a 1996 assessment by the State Department on how many certified and uncertified claims were out there, and so that had estimated approximately 75,000 to 200,000 potential claims that could be at play here. Of course, because we have restricted this exclusively to the Cuban entities and sub-entities on the Cuba Restricted List, that affects the final determination of how many claims are out there.

Again, on the question of joint ventures, you can – the shortest way of putting it is that you can sue the Cuban entity or the Cuban sub-entity. This action does not authorize the suit of a European, a Japanese, any other company from other countries. It’s only action brought against a Cuban entity or the Cuban sub-entity on a property on the Cuba Restricted List.

MODERATOR: Go to the next question, please.

OPERATOR: We will now go to the line of Christina Smith from Voice of America. Please, go ahead.

QUESTION: Hello. Thank you. I was wondering if this measure or this decision from Secretary Pompeo was made on the basis of what’s going on in Venezuela. Is this to put pressure on the Maduro government?

SENIOR STATE DEPARTMENT OFFICIAL: Thanks for that question. So the determination by the Secretary was made based off an analysis of the two statutory requirements in the LIBERTAD Act, the first of which being it – waivers only authorized in the case of a U.S. national interest as well as whether a waiver allows for an expedited transition to democracy. Those were the factors that the Secretary took under consideration.

MODERATOR: Thank you. We’ll go to the next question.

OPERATOR: Michele Keleman from NPR. Please, go ahead.

QUESTION: (Inaudible) of the 200,000 potential claims, are you expecting any actual lawsuits coming out of this more restricted version of Title III, any percentage of that up to 200,000? And then secondly, the – have – has this administration had any discussions with Cuba about claims and compensations? The foreign ministry has said that they are open to such a dialogue.

SENIOR STATE DEPARTMENT OFFICIAL: Thanks very much for that question. So with respect to your first one, it’s hard to say the exact number of lawsuits. This would be dependent on private action, so we can’t speculate on that. And with respect to your second question, not under this current administration.

MODERATOR: Thank you. We’ll go to the next question, please.

OPERATOR: We will now go to the line of Kylie Atwood, CBS. Please, go ahead.

QUESTION: Yeah, hi, thanks for doing this. Quick question: Could you just clarify what you said at the top about Cuban military intelligence and security forces and exactly how that plays into this? I was just a little confused. Thank you.

SENIOR STATE DEPARTMENT OFFICIAL: Sure, no problem. So the mention of those entities is because those are the entities on the – basically, the Cuba Restricted List identifies entities and sub-entities under the control of those authorities, so the military intelligence and security services. And so because we are – we have an exemption to the waiver for those Cuban entities and sub-entities on the Cuba Restricted List, that’s why we mentioned the Cuban military and intelligence and security forces.

MODERATOR: Thank you. We’ll go to the next question.

OPERATOR: Our next question comes from Andrew O’Reilly from Fox News. Please, go ahead.

QUESTION: Yeah, thanks for taking the call. I just – just wondering – following up on some of my colleagues have said about the kind of role that this will play when brought to the courts or when U.S. citizens or former Cuban citizens bring these suits to federal courts. It seems – and correct me if I’m wrong here, but it seems like it would be a symbolic thing more than anything legally binding to Cuba. Can you just kind of describe kind of what the process would be and what the government hopes to get out of this?

SENIOR STATE DEPARTMENT OFFICIAL: Sure, thanks very much. So the importance of this action and the historic nature of it is because this is the first time that we are not fully suspending the ability to bring suits. So as you’re aware, the Cuban Government stole property from thousands of private citizens and businesses, and this action for the first time is holding the Cuban Government and especially, as mentioned, these forces – security forces, intelligence and military forces – accountable. It’s finally giving claimants a measure of recourse and the opportunity to bring suits against these entities.

MODERATOR: All right, thank you. We have time for one lest question.

OPERATOR: All right. We will go to the line of Karen DeYoung with Washington Post. Please, go ahead.

QUESTION: Hi. Sorry, it’s me again. I just – the question I asked about whether this applies only to people who were U.S. citizens at the time of the confiscation or also to Cubans who were Cuban citizens at the time but are now U.S. citizens.

SENIOR STATE DEPARTMENT OFFICIAL: Thank you very much. Yes, it applies to all of the above. It is not just restricted to those who were U.S. citizens at the time.