Trump’s Message To Cuba To “Make A Deal” May Not Be A Bad Deal For Cuba. Witkoff And Kushner Add Another Assignment. 23 February 2026 Is Consequential.

/Trump’s Message To Cuba To “Make A Deal” May Not Be A Bad Deal For Cuba

On The Road Again… Witkoff And Kushner Adding To Their Envoy, Son-In-Law Portfolios

Return Of Mauricio Claver-Carone

Compensation For Certified Claimants

Cuba Had Opportunity From 2015-2017 To Extinguish At Least Three Highly Visible Claims Without “Paying” Anything. They Refused.

Watch 23 February 2026 For Arguments In Two United States Supreme Court Decisions Which Will Influence Trump-Vance Administration

United States Supreme Court Decisions Could Be Impetus To Change Libertad Act To Make It More Expansive For Plaintiffs And More Expensive For Defendants

Donald Trump, President of the United States (2017-2021 and 2025-2029), upon confirming the abduction of Nicolas Maduro, President of Venezuela (2013-2026), shared that the government of the United States was “running” Venezuela.

He stated the export of oil from Venezuela would be controlled by the government of the United States.

He spoke of compensating United States-based companies whose assets were expropriated without compensation by successive governments of Venezuela.

The government of the Republic of Cuba dismissed overtures from the last three occupants of The White House to resolve- or at least attempt to resolve or pretend to attempt to resolve the issue of United States-based company assets expropriated without compensation by the government of the Republic of Cuba.

Successive governments of the Republic of Cuba believed they could rely upon Angola, Belarus, China, Iran, Russia, Turkiye, Venezuela, and Vietnam among other countries to prevent settling its obligations to United States-based companies and mitigating the impact of policies, regulations, and statues implemented by the government of the United States. They were correct. Until they were not.

The mention of using assets (gas, gold, minerals, oil) of the government of Venezuela to compensate United States-based companies should pique Miguel Díaz-Canel Bermúdez, President of the Republic of Cuba (2019- ), at the Palacio de Revoluciones in Havana, Republic of Cuba. It is a threat and can be an opportunity.

There are 8,821 claims against the government of the Republic of Cuba of which 5,913 awards valued at US$1,902,202,284.95 were certified by the United States Foreign Claims Settlement Commission (USFCSC) and have not been resolved for nearing sixty-five years (some assets were officially confiscated in the 1960’s, some in the 1970’s and some in the 1990’s).

The USFCSC permitted simple (not compound) interest of 6% per annum (approximately US$114,132,137.10). The current value of the certified claims is approximately US$9.3 billion.

While the Central Bank of the Republic of Cuba does have US$9.3 billion in assets and the archipelago’s resources (cobalt, gold, nickel, oil) are limited currently in quantity and extractability, there are mechanisms (duty free, fee exemption, tax suspension, a marketplace for claim values) the government of the Republic of Cuba could deploy to provide compensation for expropriated assets. One result could be a hastened return by United States companies with their capital, market access, and management strategies. Another result, perhaps more desired by the government of the Republic of Cuba would be engagement and re-engagement with non-United States-based companies who would now view or view again, the Republic of Cuba as a viable location to disperse assets.

United States-based accounting firms and United States-based law firms could become the new best friends for the government of the Republic of Cuba as they seek to successfully align the desires of their clients with the realities of the Republic of Cuba marketplace.

Given the outcomes thus far in Venezuela, not unreasonable to expect the Trump-Vance Administration (2025-2029) to engage and re-engage with the government of the Republic of Cuba if the government of the Republic of Cuba changes its behavior rather than await engagement and re-engagement until all of the desired changes in personnel within the government of the Republic of Cuba.

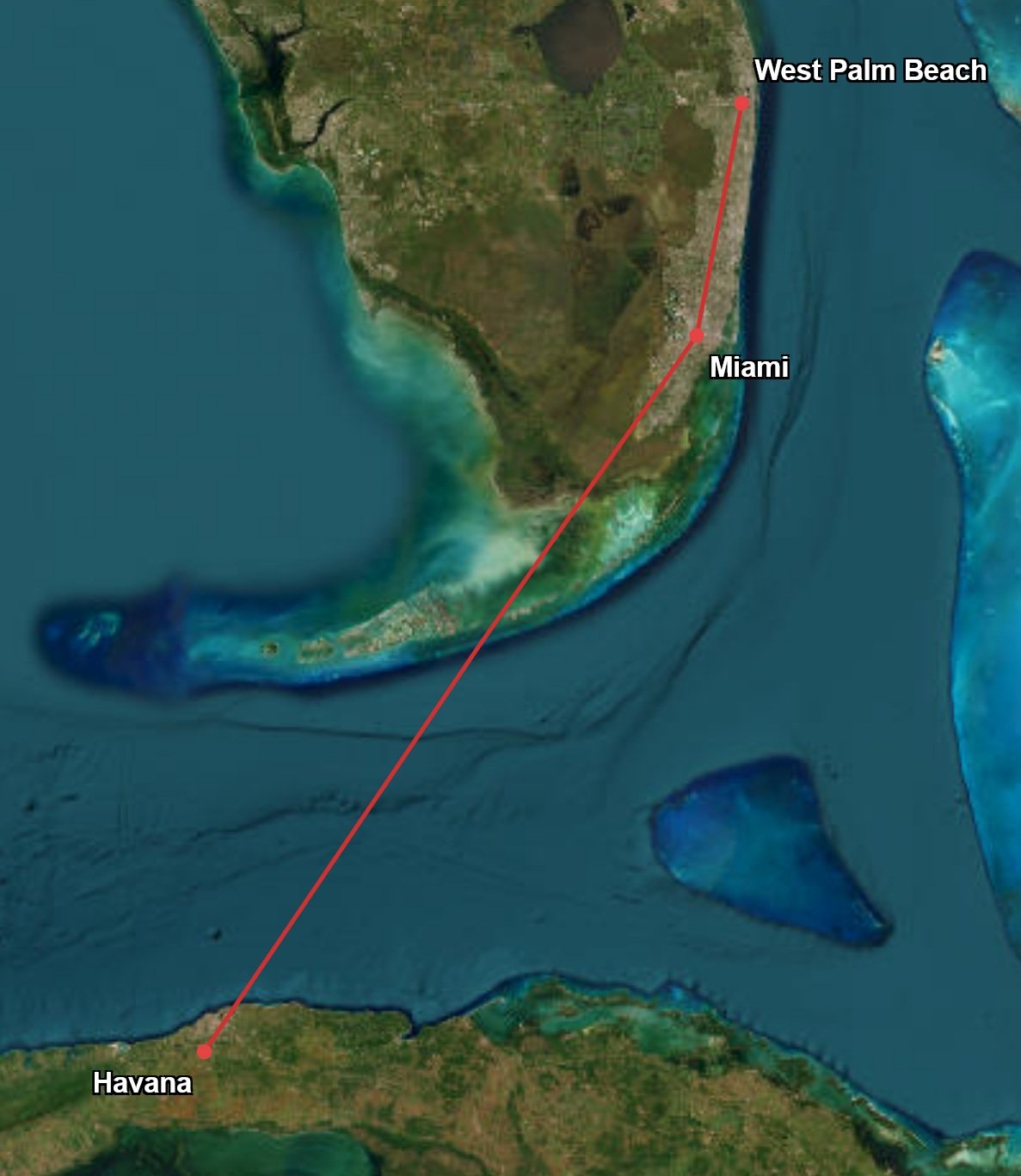

Not unreasonable to expect South Florida residents Steven Witkoff, Assistant to the President, Senior Advisor, and Special Envoy (2025- ) of the Trump-Vance Administration, and Jared Kushner, a son-in-law (2009- ) of President Trump, to be tasked by President Trump with negotiating a solution with the government of the Republic of Cuba. South Florida is home to approximately 2 million inhabitants identifying as of Cuban descent.

Whatever the post-Maduro-abduction decisions by the Trump-Vance Administration relating to the Republic of Cuba, Mauricio Claver-Carone, who resides in South Florida, and retains proximity throughout the Trump-Vance Administration, particularly with Marco Rubio, United States Secretary of State (2025- ), who has a home in South Florida, is among those who will have relevance. The government of the Republic of Cuba will hallucinate at the prospect and recoil at the reality. When appointed Senior Director, Western Hemisphere Affairs at the National Security Council (2018-2020), everyone involved in anything relating to the Republic of Cuba was terrified because for the first time in The White House was an individual whose previous life’s focus was the Republic of Cuba- and how to dismantle anything that smelled of engagement, re-engagement, cooperation, or appeasement. He had the authority and desire to use the authority- which he did with immense impact.

Two United States Supreme Court Cases

President Trump will be listening for the outcome of two cases before the United States Supreme Court both of which have oral arguments scheduled for 23 February 2026. In each case, the United States Department of Justice submitted briefs in support of the plaintiffs.

One United States District Court Judge suggested the United States Congress consider making changes to the text of Title III of the Cuban Liberty and Democratic Solidarity Act of 1996 (known as “Libertad Act”) if it disadvantaged plaintiffs.

A decision for the plaintiffs in both cases may result in new Libertad Act Title III lawsuits filed in United States District Courts- many in the State of Florida. A result could be an increase in non-United States-based company and United States-based company operational departures from the Republic of Cuba and an increase in financial institution reticence to engage with Republic of Cuba government-operated financial institutions. The tourism sector and re-emerging private sector in the Republic of Cuba will likely suffer additional hardship.

SCOTUS BLOG: Havana Docks Corporation Issue: Whether a plaintiff under Title III of the LIBERTAD Act must prove that the defendant trafficked in property confiscated by the Cuban government as to which the plaintiff owns a claim, or instead that the defendant trafficked in property that the plaintiff would have continued to own at the time of trafficking in a counterfactual world "as if there had been no expropriation."

Docket for 24-983 (Filed 13 March 2025). Title: Havana Docks Corporation, Petitioner v. Royal Caribbean Cruises, Ltd., et al. Motion to extend the time to Reply of petitioner Havana Docks Corporation filed. (Distributed) Supplemental brief of petitioner Havana Docks Corporation filed. Party name: Havana Docks Corporation

https://www.supremecourt.gov/search.aspx?filename=/docket/docketfiles/html/public/24-983.html

https://www.scotusblog.com/cases/case-files/havana-docks-corporation-v-royal-caribbean-cruises-ltd/

SCOTUS BLOG: Exxon Mobil Issue: Whether the Helms-Burton Act abrogates foreign sovereign immunity in cases against Cuban instrumentalities, or whether parties proceeding under that act must also satisfy an exception under the Foreign Sovereign Immunities Act.

Docket for 24-699 (Filed 31 December 2024). Title: Exxon Mobil Corporation, Petitioner v. Corporación Cimex, S.A. (Cuba), et al. Brief of respondents Corporación CIMEX, S.A. (Cuba), et al. in opposition filed. Brief of Corporación CIMEX, S.A. (Cuba), Corporación CIMEX, S.A (Panama), Unión Cuba-Petróleo submitted.

https://www.supremecourt.gov/search.aspx?filename=/docket/docketfiles/html/public/24-699.html

https://www.scotusblog.com/cases/case-files/exxon-mobil-corp-v-corporacion-cimex-s-a/

Docket for 24A330 (Filed 7 October 2024). Title: Exxon Mobil Corporation, Applicant v. Corporación Cimex, S.A. (Cuba), et al. United States Court of Appeals for the District of Columbia Circuit Application (24A330) to extend the time to file a petition for a writ of certiorari from October 28, 2024 to December 27, 2024

https://www.supremecourt.gov/search.aspx?filename=/docket/docketfiles/html/public/24a330.html

From 2015 to 2017, during the Obama-Biden Administration (2009-2017), Raúl Modesto Castro Ruz, President of the Republic of Cuba (2008-2018), had opportunities to engage deeply and widely with United States-based companies including to begin a negotiation about the certified claims. He did not.

One consequence was during the Trump-Pence Administration (2017-2021) much, but not all, of the commercial, economic, and financial engagement commenced in 2015 was interrupted. Although anticipated due to President Trump’s real estate dealing background, the Trump-Pence Administration did not seek negotiations on behalf of the certified claimants.

The Biden-Harris Administration (2021-2025) reversed some, but not all, decisions implemented by the Trump-Pence Administration. One new initiative was the 10 May 2022 license issued by the Office of Foreign Assets Control (OFAC) of the United States Department of the Treasury authorizing from the United States private sector direct financing and direct investment into a Republic of Cuba-based private company owned by Republic of Cuba national. Unfortunately, the government of the Republic of Cuba has yet to issue regulations necessary to deliver the financing and investment. The lack of regulations- now nearing four years, impacts sourcing of financing and investment for all countries, including those which the government of the Republic of Cuba deems as friendly- Belarus, China, Iran, Russia, Spain, Turkiye, and Vietnam.

Opportunities Missed To Settle Certified Claims

Delta Air Lines & Western Union Plus US$1.15 Million Could Be Keys To Resolving Certified Claims June 04, 2019

The Trump-Pence Administration (2017-2021) on 2 May 2019 made operational Title III of the Cuban Liberty and Democratic Solidarity Act of 1996 (known as “Libertad Act”).

Title III authorizes lawsuits in United States District Courts against companies and individuals who are using a certified claim or non-certified claim where the owner of the certified claim or non-certified claim has not received compensation from the Republic of Cuba or from a third-party who is using (“trafficking”) the asset.

Certified Claims Background

There are 8,821 claims of which 5,913 awards valued at US$1,902,202,284.95 were certified by the United States Foreign Claims Settlement Commission (USFCSC) and have not been resolved for nearing sixty-five years (some assets were officially confiscated in the 1960’s, some in the 1970’s and some in the 1990’s).

The USFCSC permitted simple interest (not compound interest) of 6% per annum (approximately US$114,132,137.10); with the approximate current value of the 5,913 certified claims is approximately US$9.3 billion.

The first asset (along with 382 enterprises the same day) to be expropriated by the Republic of Cuba was an oil refinery on 6 August 1960 owned by White Plains, New York-based Texaco, Inc., now a subsidiary of San Ramon, California-based Chevron Corporation (USFCSC: CU-1331/CU-1332/CU-1333 valued at US$56,196,422.73).

From the certified claim filed by Texaco: “The Cuban corporation was intervened on June 29, 1960, pursuant to Resolution 188 of June 28, 1960, under Law 635 of 1959. Resolution 188 was promulgated by the Government of Cuba when the Cuban corporation assertedly refused to refine certain crude oil as assertedly provided under a 1938 law pertaining to combustible materials. Subsequently, this Cuban firm was listed as nationalized in Resolution 19 of August 6, 1960, pursuant to Cuban Law 851. The Commission finds, however, that the Cuban corporation was effectively intervened within the meaning of Title V of the Act by the Government of Cuba on June 29, 1960.”

The largest certified claim (Cuban Electric Company) valued at US$267,568,413.62 is controlled by Boca Raton, Florida-based Office Depot, Inc. The second-largest certified claim (International Telephone and Telegraph Co, ITT as Trustee, Starwood Hotels & Resorts Worldwide, Inc.) valued at US$181,808,794.14 is controlled by Bethesda, Maryland-based Marriott International; the certified claim also includes land adjacent to the Jose Marti International Airport in Havana, Republic of Cuba. The third-largest certified claim valued at US$97,373,414.72 is controlled by New York, New York-based North American Sugar Industries, Inc. The smallest certified claim is by Sara W. Fishman in the amount of US$1.00 with reference to the Cuban-Venezuelan Oil Voting Trust.

The two (2) largest certified claims total US$449,377,207.76, representing 24% of the total value of the certified claims. Thirty (30) certified claimants hold 56% of the total value of the certified claims. This concentration of value creates an efficient pathway towards a settlement.

Title III of the Cuban Liberty and Democratic Solidarity (Libertad) Act of 1996 requires that an asset had a value of US$50,000.00 when expropriated by the Republic of Cuba without compensation to the original owner. Of the 5,913 certified claims, 913, or 15%, are valued at US$50,000.00 or more.

The ITT Corporation Agreement

In July 1997, then-New York City, New York-based ITT Corporation and then-Amsterdam, the Netherlands-based STET International Netherlands N.V. signed an agreement whereby STET International Netherlands N.V. would pay approximately US$25 million to ITT Corporation for a ten-year right (after which the agreement could be renewed and was renewed) to use assets (telephone facilities and telephone equipment) within the Republic of Cuba upon which ITT Corporation has a certified claim valued at approximately US$130.8 million. ETECSA, which is now wholly-owned by the government of the Republic of Cuba, was a joint venture controlled by the Ministry of Information and Communications of the Republic of Cuba within which Amsterdam, the Netherlands-based Telecom Italia International N.V. (formerly Stet International Netherlands N.V.), a subsidiary of Rome, Italy-based Telecom Italia S.p.A. was a shareholder. Telecom Italia S.p.A., was at one time a subsidiary of Ivrea, Italy-based Olivetti S.p.A. The second-largest certified claim (International Telephone and Telegraph Co, ITT as Trustee, Starwood Hotels & Resorts Worldwide, Inc.) valued at US$181,808,794.14 is controlled by Bethesda, Maryland-based Marriott International.