Trump Administration Opens Diplomatic Door To Cuba: First, Change The Economy. Second, Invite U.S. Companies. Third, For Now, Type Of Government Not Important- Just Make It Work Like China, Vietnam

/The Trump-Vance Administration (2015-2025) as anticipated is not requiring from the government of the Republic of Cuba a change to its political operating system as the condition of a rapprochement.

Donald Trump, President of the United States (2017-2021 and 2025-2029), remains focused on how a government manages its commercial, economic, and financial infrastructure rather than the type of government in place.

The People’s Republic of China and Socialist Republic of Vietnam are each governed by a Communist Party. Each country has embraced ideological decision-making which creates an economy operating in the black rather than an economy operating in the red. Each country provides opportunities for United States-based companies.

Regardless of whether a country has an authoritarian, democratic, dictatorship, junta, military, monarchy, oligarchy, parliamentary, participatory, presidential, theocracy, totalitarian, or some other system of governance, President Trump is focused upon what opportunities exist for United States-based companies: exporting products, importing products, and provision of services.

Nicolas Maduro, President of the Bolivarian Republic of Venezuela (2013-2025), was removed through an operation conducted by the armed forces of the United States. The Trump-Vance Administration then engaged with the individuals and the institutions remaining in place rather than requiring changes in personnel and to structures. The focus was first upon recreating in Venezuela opportunities for United States-based companies.

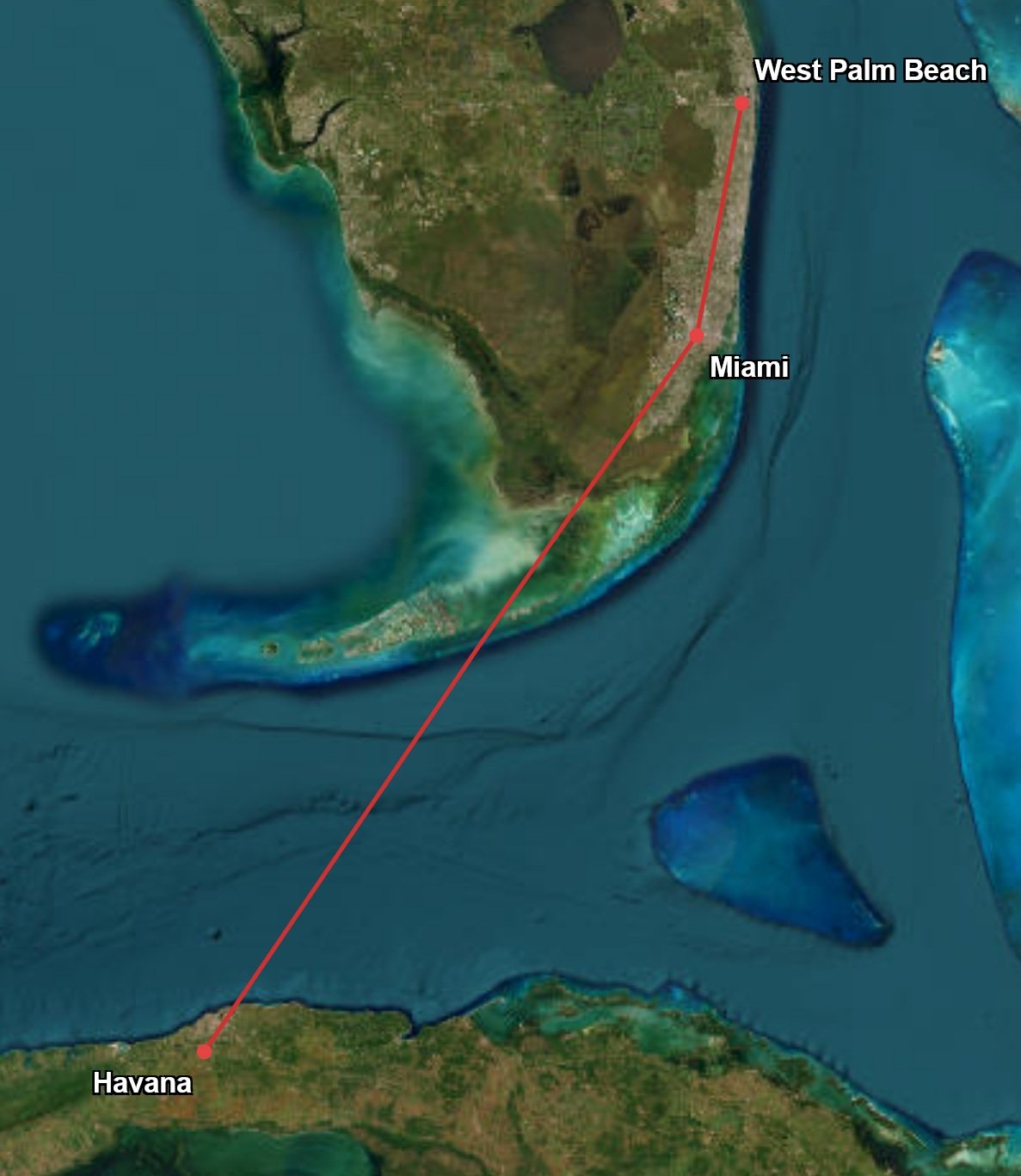

There is not a required optic for the armed forces of the United States to conduct an operation to extract Miquel Diaz-Canel, President of the Republic of Cuba (2019- ), from the Palacio de la Revolución in the city of Havana.

President Maduro was viewed as the optical and personality problem to implementing changes in Venezuela. President Diaz-Canel is not viewed similarly. He is not viewed in control of the government of the Republic of Cuba in the same way as President Maduro was viewed as in control of the government of Venezuela. President Maduro was a symbol whose replacement had political value to President Trump. President Diaz-Canel is neither a personality nor a symbol in the same manner as President Maduro.

The Diaz-Canel-Valdes Mesa Administration (2019- ) in the Republic of Cuba is not for some in the Trump-Vance Administration the problem. The problem is the manner the government of the Republic of Cuba uses its chosen political system to manage its economy.

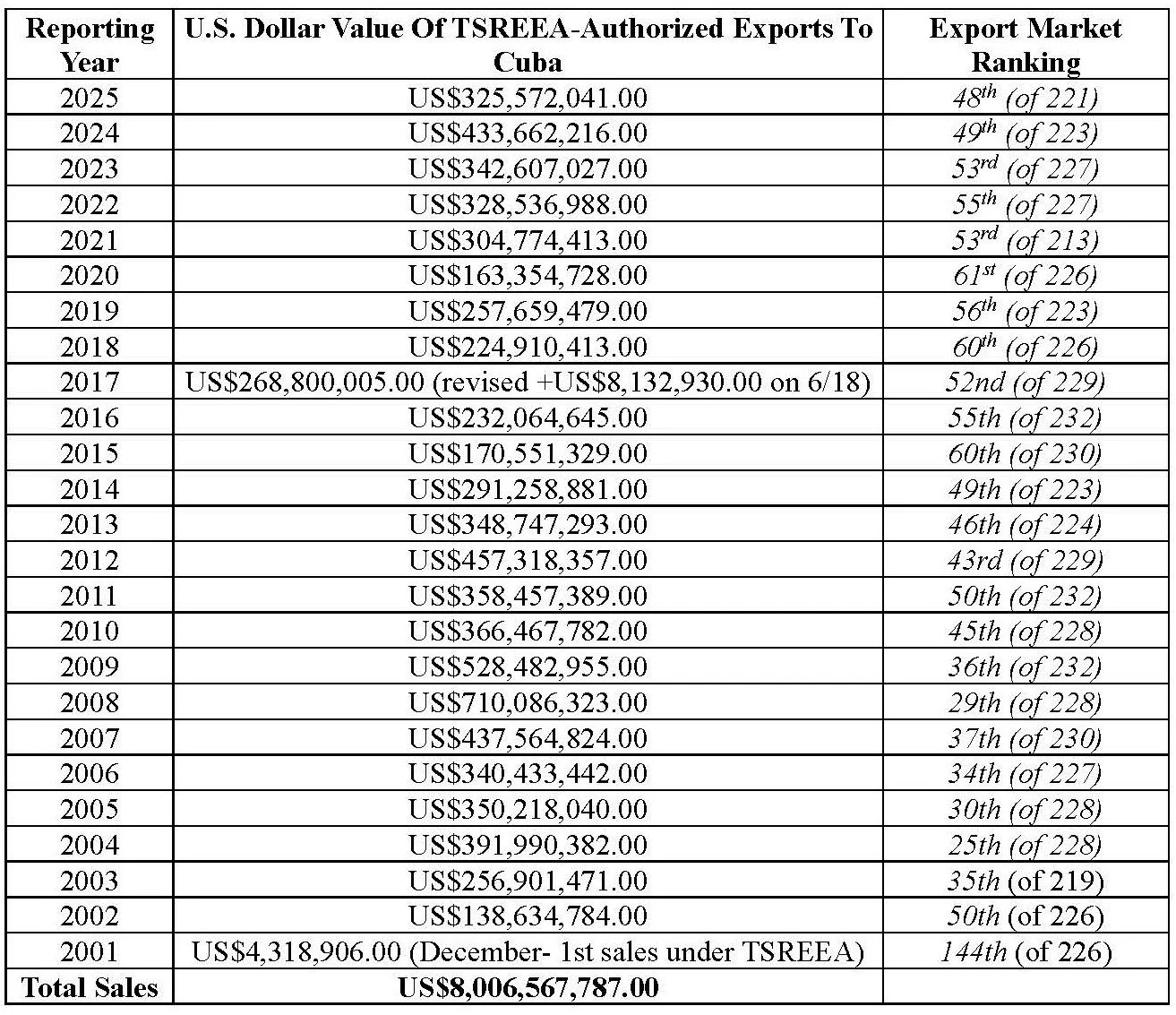

Policies, regulations, and statutes implemented by the government of the United States do impact negatively the commercial, economic, and financial functionality of the government of the Republic of Cuba.

Ironically, some of the policies, regulations, and statutes if accepted could strengthen the government of the Republic of Cuba by providing additional capital, additional markets, and additional bilateral political connectivity.

Within those policies, regulations, and statutes are opportunities the government of the Republic of Cuba has avoided which have contributed to the corrosion and decay of the commercial, economic, and financial infrastructure in the Republic of Cuba.

In May 2022, the Biden-Harris Administration (2021-2025) authorized direct investment and direct financing into a privately-owned company located in the Republic of Cuba owned by a Republic of Cuba national. Nearing four years later, the government of the Republic of Cuba has not issued the necessary guidance and regulations. One page to be filed by the Republic of Cuba-based company with its Republic of Cuba government-operated financial institution; similar to a Know Your Customer form, authorizing officially the direct investment and direct financing.

The lack of guidance and regulations from the government of the Republic of Cuba has also impacted sources of capital from every other country- including those with whom the government of the Republic of Cuba embraces- China and Russia, along with the twenty-seven-member country Brussels, Belgium-based European Union (EU) among others.

The Trump-Vance Administration would permit the Diaz-Canel-Valdes Mesa Administration to implement changes to its commercial, economic, and financial infrastructure while maintaining most of its political infrastructure.

However, the infrastructure needs to transition quickly from what did not work in the second half of the twentieth century to what can work in the beginning of the second quarter of the twenty-first century.

President Trump is enticed and impressed by opportunity. The New York, New York-based The Trump Organization did have an interest in tourism-related opportunities in the Republic of Cuba. For the government of the Republic of Cuba, that sector can be the basis for re-engagement with the Trump-Vance Administration.

Link To Related Analysis

At SPIEF’25 Russia-Cuba Dialogue, One Side Talks Dreams, Other Talks Reality. “Reliable Partner”- “Science Fiction” Or Reality? Russia Says Entrepreneurs Important. Cuba Not So Enthusiastic June 19, 2025

Munich, Germany

Hotel Bayerischer Hof

14 February 2026

Secretary of State Marco Rubio with John Micklethwait of Bloomberg News

excerpts

QUESTION: What about a country with which you’ve had a long interest: Cuba? You mentioned it obliquely in the speech talking about the Cuban Missile Crisis. How long do you think the regime can last without oil?

SECRETARY RUBIO: Yeah, I think the regime in Cuba is – look, the revolution in Cuba ended a long time ago and – Cuba’s fundamental problem is that it has no economy and its economic model is one that has never been tried and has never worked anywhere else in the world, okay? It just – it doesn’t have a real economic policy. It doesn’t have a real economy. Now, forget – put aside for a moment the fact that it has no freedom of expression, no democracy, no respect for human rights. The fundamental problem Cuba has it is has no economy, and the people who are in charge of that country, in control of that country, they don’t know how to improve the everyday life of their people without giving up power over sectors that they control. They want to control everything. They don’t want the people of Cuba to control anything. So they don’t know how to get themselves out of this. And to the extent that they have been offered opportunities to do it, they don’t seem to be able to comprehend it or accept it in any ways. They would much rather be in charge of the country than allow it to prosper.

QUESTION: Is there any kind of off-ramp for the regime? I mean, previous ones – when you negotiated with Venezuela, you said if they agreed with various things it would be possible to continue.

SECRETARY RUBIO: Sure. I mean, there is. I mean, look, I think you have to —

QUESTION: What could – what could the Cuban regime do to —

SECRETARY RUBIO: Well, I’m not going to tell you or announce this in an interview here because obviously these things require space and time to do in the right way. But I will say this, that that is that it is important for the people of Cuba to have more freedom, not just political freedom but economic freedom. The people of Cuba – and that’s what this regime has not been willing to give them because they’re afraid that if the people of Cuba can provide for themselves, they lose control over them, they lose power over them. So I think there has to be that opening and it has to happen, and I think now Cuba is faced with such a dire situation. Remember this is a regime that has survived almost entirely on subsidies – first from the Soviet Union, then from Hugo Chavez, and how for the first time it has no subsidies coming in from anyone, and the model has been laid bare. And it’s not just – look, multiple countries have gone in and helped, but the problem is that you lose money in Cuba. They never pay their bills. They never end up paying. It never ends up working out. There were European countries that went to Cuba and made what they thought were investments in certain sectors, only to have them – the contracts canceled and get themselves kicked out because the Cuban regime has no fundamental understanding of what business and industry looks like, and the people are suffering as a result of it. So I think certainly their willingness to begin to make openings in this regard is one potential way forward. I would also say – and this has not been really talked about a lot, but the United States has been providing humanitarian assistance directly to the Cuban people via the Catholic Church. We did it after the hurricane. We actually just recently announced an increase in the amount we’re willing to give. And that’s something we’re willing to continue to explore, but obviously that’s not a long-term solution to the problems on the island.

Secretary Rubio’s Meeting with G7 Foreign Ministers

United States Department of State

Washington DC

14 February 2026

The below is attributable to Principal Deputy Spokesperson Tommy Pigott:

Secretary of State Marco Rubio met today with G7 foreign ministers in Munich, Germany. The leaders discussed pressing issues such as ongoing conflicts threatening peace and stability in Africa, Europe, and the Middle East, as well as challenges to regional security in the Indo-Pacific and the Western Hemisphere. The Secretary reiterated the United States’ commitment to promoting stability in Venezuela and negotiating an end to the Russia-Ukraine war. Secretary Rubio and his counterparts reaffirmed the importance of strengthening G7 cooperation to address global threats to international peace and security.