Chairman Of Committee On Foreign Affairs Of U.S. House Of Representatives May Visit Cuba. This Is What His "Deliverables" Agenda Should Include.

/Chairman of the Committee on Foreign Affairs of the United States House Of Representatives May Visit Cuba.

For United States Business Community, Deliverables Are Important. Focus Upon MSMEs. Banking. Four Important Meetings.

Chairman Of Congressional Black Caucus May Participate.

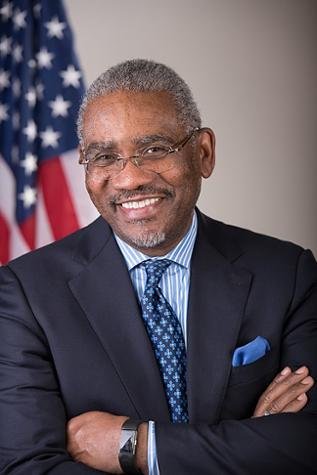

From Biography: “[First elected in 1998], Congressman Meeks [Democrat, 5th District New York] is Chairman [2021- ] of the House Foreign Affairs Committee, the first black Member of Congress to serve as Chair of that committee. Meeks [68] is a multilateralist with decades of experience in foreign policy. He believes that the United States should build coalitions around our interests and work with other countries to build a stable and prosperous future.” Representative Meeks visited the Republic of Cuba in 2006, 2014, and 2016.

Chairman Meeks probably has anticipated the following, and his staff has probably included the subjects in his briefing materials, but reinforcement is often useful…

The Biden-Harris Administration (2021- ) is focusing upon supporting the re-emerging private sector in the Republic of Cuba: micro, small, and medium-size enterprises (MSMEs).

Thus, the likelihood and policy initiatives and changes, and regulatory changes supported by The White House will focus upon lessening impediments upon the re-emerging private sectors in the Republic of Cuba.

In May 2022, the Biden-Harris Administration authorized the first direct equity investment in and the first direct financing to a privately-owned company located in the Republic of Cuba. Subsequently, the Office of Foreign Assets Control (OFAC) of the United States Department of the Treasury added opportunities and amended existing regulations to provide mechanisms for further engagement with privately-owned companies located in the Republic of Cuba. In July 2022, the government of the Republic of Cuba confirmed direct equity investment and direct financing are authorized for MSMEs. The regulations have yet to be published.

To support the commercial and economic bilateral relationship of the United States with the Republic of Cuba, the ideal agenda for Chairman Meeks will include meetings with officials who have direct responsibility for the role of MSMEs in the Republic of Cuba.

A goal should be to influence officials of the government of the Republic of Cuba who are crafting regulations for MSMEs to receive direct equity investments from the United States and direct financing from the United States.

Link To Previous Analysis: Now The Hard Part For Cuba: Implementing Quickly Transparent, Equal-For-All, MSME Investment & Financing Regulations. No Limitations. No Selectivity. No Orwellian Process.

Suggested Agenda Schedule

First meeting with Benjamin Ziff, Chargé d'Affaires of the Embassy of the United States.

Second meeting with Alejandro Gil, Minister of Economy and Planning of the Republic of Cuba; Marta Sabina Wilson Gonzalez, President of the Central Bank of the Republic of Cuba; and Ania Carnero Manresa, President of Banco Internacional de Comercio S.A. (BICSA).

Third meeting with Rodrigo Malmierca Díaz, Minister of Foreign Trade and Foreign Investment of the Republic of Cuba; and Antonio Luis Carricarte, President of the Chamber of Commerce of the Republic of Cuba.

Fourth meeting with Miguel Diaz-Canel, President of the Republic of Cuba; Manuel Marrero, Prime Minister of the Republic of Cuba; and Bruno Rodriguez, Minister of Foreign Affairs of the Republic of Cuba.

Critical for MSMEs is for the government of the Republic of Cuba to maintain a dynamic and easily accessible online directory of MSMEs with 1) identifiers as to both direct and indirect ownership of each MSME 2) the operational address for each MSME and 3) contact information for each MSME. An article published on 5 August 2022 by The Miami Herald and El Nuevo Herald illustrates why a directory is required:

Link: Miami Herald U.S.-based online food stores were meant to help Cubans. Why are they selling Havana Club?

Link: El Nuevo Herald Tiendas de alimentos de EEUU debían ayudar a los cubanos. ¿Por qué venden Havana Club?

For the Biden-Harris Administration, lack of a directory will impede the expansion of engagement with MSMEs and may impact those policy and regulatory changes in place relating to MSMEs- particularly those focused upon direct equity investment in and direct financing to MSMEs authorized by the OFAC.

A priority for the government of the Republic of Cuba must be transparency as to the ownership and legal status of Republic of Cuba government-operated companies and MSMEs. Absent self-installed transparency, the United States Department of State is likely to be pressured by members of the United States Congress to create a sub-section to the Cuba Restricted List (CRL) to identify MSMEs prohibited from receiving direct equity investment and direct financing from individuals and entities subject to United States jurisdiction. Such a sub-section would have a chilling effect and stunt engagement with MSMEs. The existence of a CRL referencing MSMEs would taint all MSMEs regardless of their ownership and purpose.

Critical for a result of discussions led by Chairman Meeks is to obtain confirmation that Banco Internacional de Comercio S.A. (BICSA) will grant Elk Grove Village, Illinois-based First American Bank (2021 assets approximately US$5 billion) a correspondent account and BICSA will agree to seek through First American Bank a license from the OFAC to have a correspondent account with First American Bank. BICSA is not among the financial institutions included in the CRL. BICSA was vetted previously by the OFAC: Since 2015, Conway, Arkansas-based Home BancShares (2021 assets approximately US$18 billion) through subsidiary Centennial Bank (and before that subsidiary Stonegate Bank) have correspondent accounts with BICSA.

Once First American Bank and BICSA have accounts with one another, funds to the Republic of Cuba and funds from the Republic of Cuba will move transparently, efficiently, and directly within minutes rather than days through third-countries as currently required by the OFAC- a decision implemented during the Obama-Biden Administration (2009-2017). This efficiency is essential for the sustained engagement by United States-based sources of direct equity investment and direct financing to MSMEs.

From OFAC: “744. May correspondent accounts authorized pursuant to 31 CFR § 515.584(a) or used for transactions authorized by 31 CFR § 515.584(g) be established and maintained in U.S. dollars? Yes. Correspondent accounts of depository institutions (as defined in 31 CFR § 515.333) at a financial institution that is a national of Cuba authorized pursuant to § 515.584(a) may be established and maintained in U.S. dollars. Such accounts may be used only for transactions that are authorized by or exempt from the CACR. Transactions necessary to establish and maintain such correspondent accounts- such as originating, processing, and terminating authorized funds transfers in U.S. dollars- are authorized. Additionally, correspondent accounts used for transactions authorized by 31 CFR § 515.584(g), which permits banking institutions as defined in 31 CFR § 515.314(g) that are persons subject to U.S. jurisdiction to accept, process, and give credit to U.S. dollar monetary instruments presented indirectly by a financial institution that is a national of Cuba, may be denominated in U.S. dollars. However, financial institutions that are nationals of Cuba remain prohibited from opening correspondent accounts at a U.S. financial institution. For a complete description of what these general licenses authorize and the restrictions that apply, see 31 CFR § 515.584(a) and (g).” LINK: https://www.ecfr.gov/current/title-31/subtitle-B/chapter-V/part-515/subpart-E/section-515.584

Resumption of direct correspondent banking will materially impact the flow of remittances. Important for the government of the Republic of Cuba to authorize a Republic of Cuba government-operated financial institution to receive/send remittances that is not among financial institutions included in the CRL. BICSA is the logical candidate as it has experience with operating correspondent accounts with United States-based financial institutions, and soon with First American Bank. The resumption of direct correspondent banking would permit again Denver, Colorado-based Western Union Company (2021 revenues approximately US$5.1 billion) to provide a full suite of services to customers throughout the United States, particularly in support of MSMEs.

Focusing upon changes to United States statutes relating to payment terms of the Trade Sanctions Reform and Export Enhancement Act (TSREEA) of 2000 is not today a priority for United States exporters nor viable in terms of legislative success. The payment process is a priority. The easier the payment process, the more opportunities for an expansion of the sourcing for exports from the United States to the Republic of Cuba.

For example, since December 2001 more than US$6.8 billion in payments by the government of the Republic of Cuba for agricultural commodities, food products, and healthcare products (medical equipment, medical instruments, medical supplies, pharmaceuticals), and other products purchased from United States-based companies have traveled through third-country financial institutions prior to arriving to United States-based financial institutions. These transactions are authorized by the TSREEA, Cuban Democracy Act (CDA) of 1992, and OFAC and Bureau of Industry and Security (BIS) of the United States Department of Commerce regulations. Funds from the United States to the Republic of Cuba have been required to endure the same costly and inefficient triangular payment process.

Absent direct correspondent banking, authorized transactions from the Republic of Cuba to the United States are less transparent and are multi-day rather than multi-hour and third parties earn unnecessary fees. MSMEs will primarily engage in small transactions, so excessive costs and delays associated with receiving and sending funds is impactful to their bottom-line. The fewer impediments for MSMEs, the more likely they will import more products from the United States.

For the United States business community (companies and individuals), having in place regulations within the Republic of Cuba that make attractive engaging with MSMEs along with regulations in place in the United States that make the movement of funds cost effective, transparent, and efficient, will result in robust engagement between the re-emerging private sectors in the Republic of Cuba and the United States.