Should EU Promote For Cuba An SPV Designed To Protect Iran From OFAC?

/Will EU’s Effort To Create SPV For Cuba Help Or Harm?

Rather Than EU Creating A Work-Around, It Should Encourage Cuba To Settle U.S. Issues

EU Can Shepard Cuba Towards Negotiations With The U.S. Rather Than Creating Further Distance?

EU Has Much To Gain From Resolution Of U.S.-Cuba Issues

Does Cuba Benefit Financially Or Politically From Using An Instrument Created For Iran?

SPV Will Create Unnecessary Elasticity In U.S.-Cuba Relationship

The Republic of Cuba’s problem is not that it lacks a mechanism to make payments to vendors. The problem is a chronic inability to consistently make payments to vendors when due which is substantially a result of inefficiencies within its commercial, economic and political infrastructure and the laws, regulations and policies which impact the ability to pay what is owned when due.

The Republic of Cuba may view a Special Purpose Vehicle (SPV) as an additional opportunity to create a financing mechanism rather than a means of consummating transactions and obligations. It can be used as an instrument for delay rather than a tool used to create prosperity.

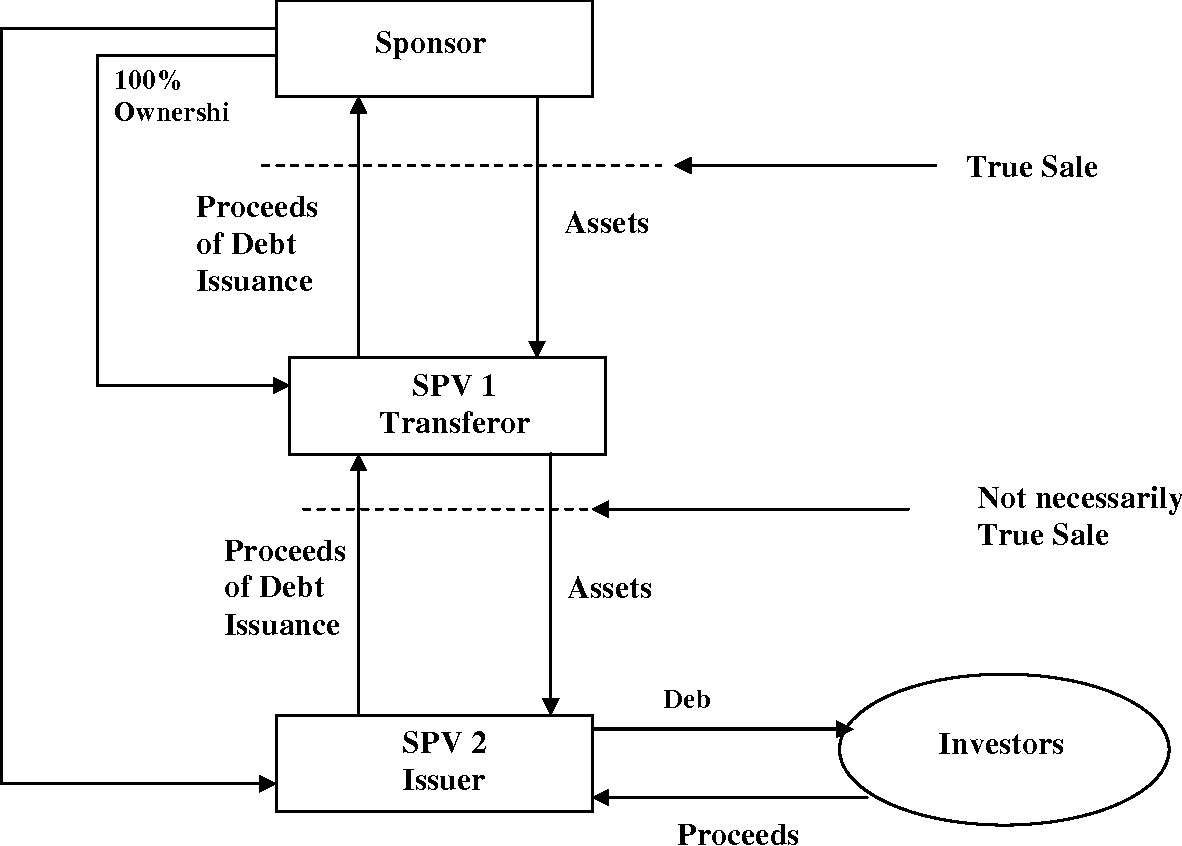

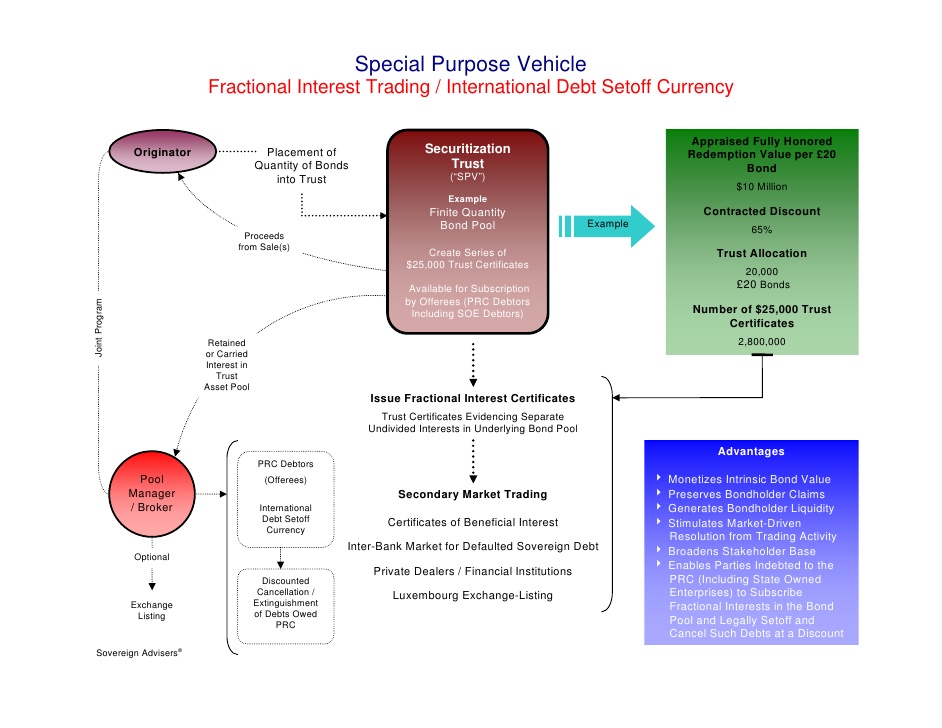

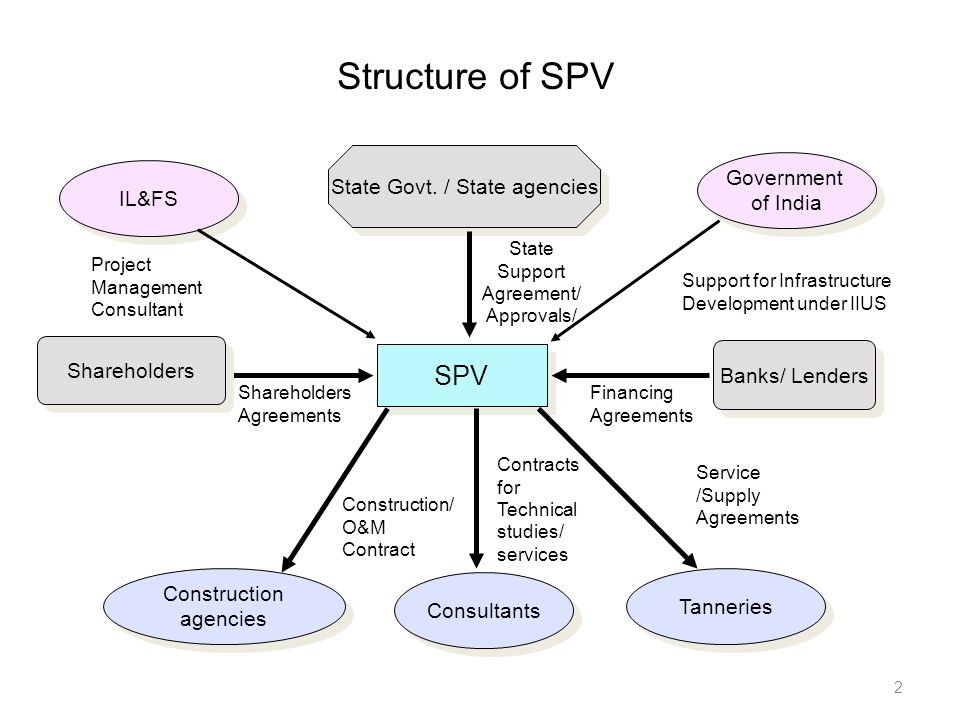

What is a SPV? According to Ms. Federica Mogherini, High Representative for Foreign Affairs and Security Policy of the EU: “…EU member states will set up a legal entity to facilitate legitimate financial transactions with Iran and this will allow European companies to continue to trade with Iran in accordance with European Union law and could be open to other partners in the world.”

How might an SPV work: Edited excerpts from one published analysis: “It could involve a barter system that would allow firms to bypass the SWIFT international bank transfer system. Credits for oil or goods imported from Iran by one EU company could be used to pay an EU exporter for its goods or services to Iran, without any funds being sent to Iran. The SPV would operate in euros rather than U.S. dollars and the OFAC won't be able to scrutinize transactions, unlike the SWIFT system, which is fully transparent. The system would be similar to one used by the then-U.S.S.R. to trade with Iran without money changing hands.”

The goal of implementing an SPV for Iran (and potentially for the Republic of Cuba) is to attempt to insulate transactions from sanctions imposed by the Trump Administration through the Office of Foreign Assets Control (OFAC) of the United States Department of the Treasury, Bureau of Industry and Security (BIS) of the United States Department of Commerce, and United States Department of State. A mechanism for the OFAC is to disrupt transactions routed through La Hulpe, Belgium-based Society for Worldwide Interbank Financial Telecommunication (SWIFT) “a global member-owned cooperative and the world’s leading provider of secure financial messaging services.”

A SPV could be functional and the Republic of Cuba could use it, but does use of an SPV assist the Republic of Cuba with making changes it does not want to make, but needs to make? Does it permit the Republic of Cuba to further delay what it must do to be a productive, responsible, reliable and profitable importer, exporter and provider of services? A marketplace today where the first consideration by a company is how it will be paid, when it will be paid, and if it will be paid; and then seek a government guarantee. This is not the type of transactional marketplace the Republic of Cuba endeavors to be- one where hesitation, rather than excitement, is the first emotion for importers, exporters, and service providers.

During the last twenty-five years, the Republic of Cuba has repeatedly required, requested and received, write-downs and write-offs of government-to-government debt and debt incurred by Republic of Cuba government-operated entities.

For some in the Republic of Cuba there exists a belief that the global community owes it for what harm the United States has brought to bear against it. That the Republic of Cuba is the mascot of the global community against the hegemony of the United States. So, the global community needs to pay its dues so that the Republic of Cuba may continue to be an example.

A strategy by the Republic of Cuba of expecting taxpayers in other countries to become shareholders in debt incurred by the Republic of Cuba- when the Republic of Cuba refuses to make changes which would alleviate that recurring theme, is not responsible; is not fair.

The use of a SPV by the Republic of Cuba will result in additional efforts by the Trump Administration to interrupt the use of a SPV by the Republic of Cuba.

The UE and other governments may support the creation and implementation of an SPV, but companies within those countries with global operations, particularly those with a presence in the United States and those with financial transactions requiring engagement with the United States Dollar, may be hesitant.

From one Europe-based senior-level financial executive: “It’s a great idea, but still only an idea. Even the Iranian SPV is proving difficult and that’s urgent! So, I don’t see anything imminent. It all depends upon the degree to which EU is prepared to cooperate with Russia and China in setting up a U.S.-excluded-para-SWIFT system.”

The Republic of Cuba would be better served by focusing less upon ways around United States laws, regulations and policies and focusing more towards actions designed to weaken them. That means negotiations. That means settling the certified claims. Both the EU and the Republic of Cuba will benefit.

Absent the issue of the certified claims, the Republic of Cuba could then play-off on a level playing field the interests of EU-based companies and United States-based companies. United States-based companies would no longer be solely proffered as bait to obtain the interest by EU-based companies; they would now be fish of equal or near-equal weight.

The Republic of Cuba should desire to be that type of marketplace- it’s the type of competition that would benefit the 11.3 million citizens of the 800-mile archipelago which lies ninety-three miles south of Key West, Florida.

LINK To complete text in PDF Format