A Cuban-American Republican Congressman Is Cuba’s New US$8 Billion Best Friend; President Trump Can't Get More Than 2 Cents On The Dollar?

/A Cuban-American Republican Congressman Is Cuba’s New US$8 Billion Best Friend

Cuba Pays Nothing & U.S. Pays Everything

President Trump Can’t Negotiate More Than US$.02 Cents On The Dollar? Really?

An Illegal Export Tax

Fifth Amendment Issues

Should Riceland Foods Pay Starwood Hotels

Should Cargill Pay Texaco

Should Grove Enterprises Pay InterContinental Hotels

Will Cuba Importers Have Access To US Government Financing Programs

Why are two Members of Congress from the Republican Party, one from Arkansas and the other from Florida, who present themselves as fiscally and constitutionally conservative- believing in responsibility for actions, constructing an alliance to provide a bailout to the government of the Republic of Cuba at the expense of United States-based companies?

For one, betrayal of the concept of fiscal responsibility. For the other, betrayal of a multi-generational family-connected and colleague-connected positions requiring that the government of the Republic of Cuba be held accountable.

For those who complained, and legitimately so, that the Obama Administration provided much and received little during its two-plus years (December 2014-January 2017) of initiatives, and was, perhaps, the last lifeguard to the government of the Republic of Cuba, the Obama Administration did not provide an US$8 billion write-off and then send a collective invoice to the 322+ million residents of the United States. That’s what two members of the United States Congress have proposed.

By withdrawing the requirement for the government of the Republic of Cuba compensate certified claimants, the United States Congress is invalidating the validity of the certified claims. The government of the Republic of Cuba will respond that if the United States isn’t asking it to make payment, they, the certified claims, must have never been valid.

Legislators often believe themselves to be physicians and legislation is their prescription to problems. The proposed legislation is a prescription that should remain unfilled. The legislation solves nothing; at minimum it postpones a resolution, at maximum it establishes a multilateral terrible precedent.

Examples Of Potential Payment Transfers

Let’s examine a series of transactions and determine the fairness quotient. In each of the following transactions, US$1 million represents 2% of the value of the product exported to Republic of Cuba government-operated Alimport. The 2% export tax is the mechanism proposed legislation uses to repay certified claimants. Food product and agricultural commodities are authorized on a “cash-in-advance” basis by the Trade Sanctions Reform and Export Enhancement Act (TSREEA) of 2000.

Will the owners, shareholders and management of these exporters be comfortable with transferring revenues- potentially to a competitor? Will there be legal action? Fifth Amendment claims?

Stuttgart, Arkansas-based Riceland Foods sells US$50 million in rice to Alimport and pays US$1 million indirectly to Stamford, Connecticut-based Starwood Hotels & Resorts International (a subsidiary of Bethesda, Maryland-based Marriott International) which has a claim valued at approximately US$51 million. The company manages the Four Points Sheraton Havana.

Minnetonka, Minnesota-based Cargill sells US$50 million in wheat to Alimport and pays US$1 million indirectly to White Plains, New York-based Texaco (a subsidiary of San Ramon, California-based Chevron Corporation) which has a claim valued at approximately US$28 million.

Wellesley, Massachusetts-based Grove Enterprises sells US$50 million in poultry to Alimport and pays US$1 million indirectly to Denham, United Kingdom-based InterContinental Hotels Group PLC which has a claim valued at approximately US$4.6 million.

Chicago, Illinois-based ADM sells US$50 million in corn to Alimport and pays US$1 million indirectly to Cincinnati, Ohio-based Procter & Gamble Co.

Salisbury, Maryland-based Perdue Agribusiness sells US$50 million in soybeans to Alimport and pays US$1 million indirectly to Atlanta, Georgia-based The Coca-Cola Company.

Chattanooga, Tennessee-based Koch Foods of Chattanooga sells US$50 million in poultry to Alimport and pays US$1 million indirectly to Boston, Massachusetts-based General Electric. The company will soon announce commercial activity in the Republic of Cuba.

Atlanta, Georgia-based AJC International sells US$50 million in poultry to Alimport and pays US$1 million indirectly to Irving, Texas-based Exxon Mobil Corporation.

Bedford, Virginia-based Sellari Enterprises sells US$50 million in poultry to Alimport and pays US$1 million indirectly to Phoenix, Arizona-based Freeport McMoRan.

The result of these eight (8) transactions from a total export value of US$400 million is a payment of US$8 million to be divided among the 5,913 claims certified by the United States Foreign Claims Settlement Commission (USFCSC) valued without interest at US$1,902,202,284.95 and with interest at approximately US$8 billion. Of the 5,913 claims certified by the USFCSC, thirty (30) companies account for approximately 57% of the value without interest.

The US$7 million represents .037% of the original value of the certified claims and .09% of the estimated current value of the certified claims.

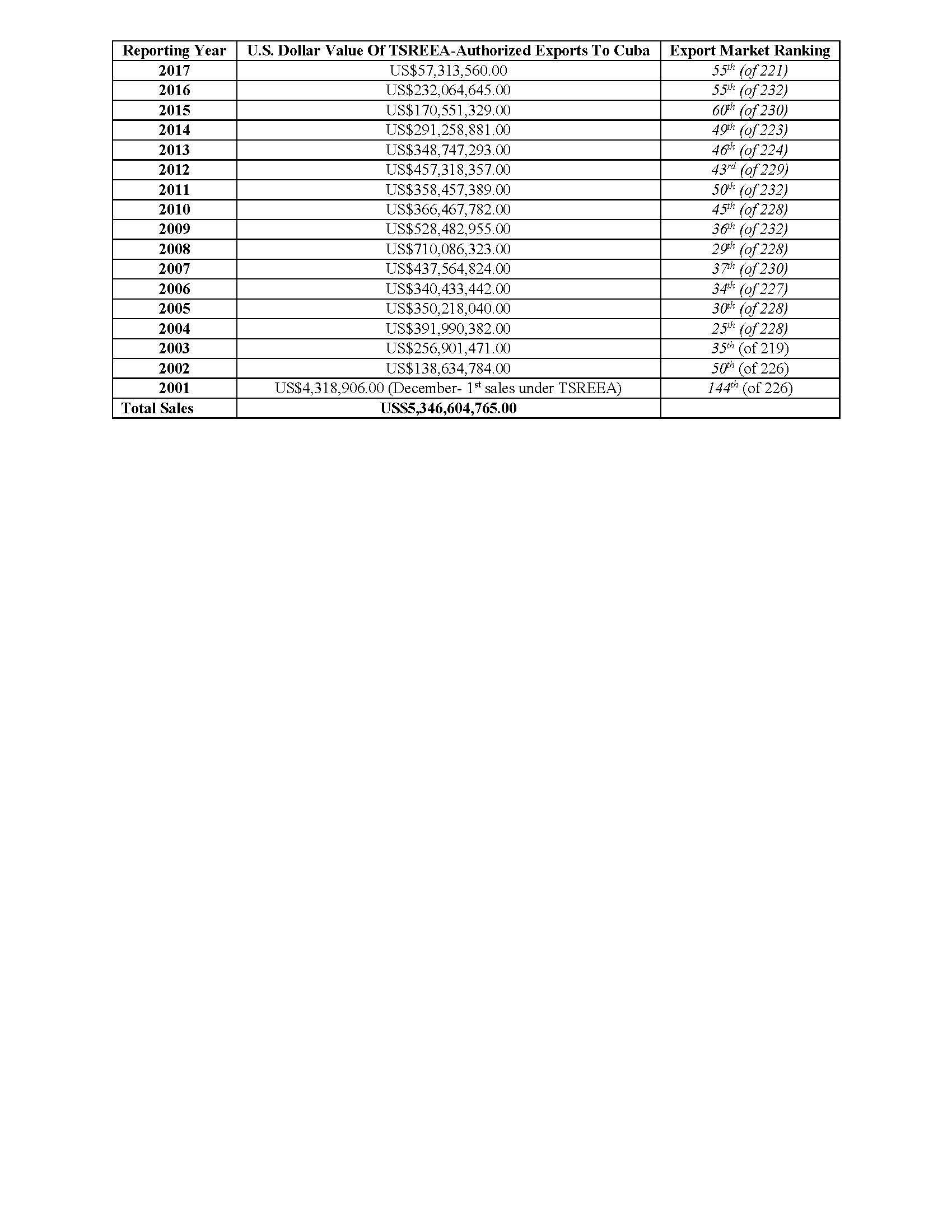

For reference, the following are the U.S. Dollar export values for TSREEA-related exports since the first deliveries in December 2001; the 2% export tax would represent US$106,932,095.30 from all TSREEA-related exports:

Reporting Year

U.S. Dollar Value Of TSREEA-Authorized Exports To Cuba

Export Market Ranking

2017

US$57,313,560.00

55th (of 221)

2016

US$232,064,645.00

55th (of 232)

2015

US$170,551,329.00

60th (of 230)

2014

US$291,258,881.00

49th (of 223)

2013

US$348,747,293.00

46th (of 224)

2012

US$457,318,357.00

43rd (of 229)

2011

US$358,457,389.00

50th (of 232)

2010

US$366,467,782.00

45th (of 228)

2009

US$528,482,955.00

36th (of 232)

2008

US$710,086,323.00

29th (of 228)

2007

US$437,564,824.00

37th (of 230)

2006

US$340,433,442.00

34th (of 227)

2005

US$350,218,040.00

30th (of 228)

2004

US$391,990,382.00

25th (of 228)

2003

US$256,901,471.00

35th (of 219)

2002

US$138,634,784.00

50th (of 226)

2001

US$4,318,906.00 (December- 1st sales under TSREEA)

144th (of 226)

Total Sales US$5,346,604,765.00

These two members of the United States Congress are establishing a treacherous precedent for resolving issues of expropriation not only with the Republic of Cuba, but with other countries which may take similar actions… The new rule will be take what you want, and United States citizens will make restitution.

Representative Rick Crawford (R- 1st District, Arkansas) believes Representative Carlos Curbelo (R- 26th District, Florida) suggested linkage of repayment for certified claimants to permitting payment terms (currently “cash-in-advance” by statute) for food products and agricultural commodity exports from the United States to the Republic of Cuba as a means of assisting, of resolving the issue of the certified claims. Representative Crawford seems jubilant.

Representative Curbelo created linkage to impede rather than encourage commerce with the government of the Republic of Cuba as it remains (as he expects it will through the Trump Administration) in the form that it does- with members of the Castro family and military officers substantively participating in the direction and leadership of the country.

A goal is to retain statutory control of bilateral issues; and, specifically, retain control by the United States Congress for changing the bilateral relationship with the Republic of Cuba rather than risk the uncertainty of decisions by the Executive Branch.

Ask the question: Why would a Cuban-American member of the United States Congress support an effort to absolve the government of the Republic of Cuba of its financial obligations when for years there was a position that “stolen property” should be returned or adequate compensation should be provided to the owner?

Perhaps, because unknown is whether the funds that would be maintained at the United States Department of the Treasury on behalf of the certified claimants might be available to individuals who have unrelated civil judgements against the government of the Republic of Cuba.

The 5,913 certified claimants have endured previous occupants (Democrat and Republican) of The White House redirecting funds reserved for repayment of the certified claims to satisfy civil judgements unrelated to the certified claims; and the invasion of those funds was supported by those with whom Representative Crawford is negotiating his legislation.

If the legislation is presented to the commercially value-focused and export-advocating Trump Administration including the Secretary of Commerce and Secretary of the Treasury, along with members of the Ways & Means Committee of the United States House of Representatives as a proposal with a potential ROI (Return On Investment) of 47 years, 133 years, 200 years, 400 years, 563 years and 1,723 years; and, this ROI calculation does not consider the impact of continuing the interest on the principal value of the certified claims, what is the logical business-school-shapedresponse? And, then add that there will be a 2% export tax.

For the legislation to have resulted in repayment to the certified claimants in 2017, the legislation would have needed to have been law during these notable dates (from recent to distant): the first Earth Day, the first roller coaster at Coney Island, the invention of the bicycle, Jamestown settlers in residence, the fall of Constantinople, and the tenure of Galerius as Emperor of Rome.

The legislation only serves Members of Congress who created it, Members of Congress who support it, and those lobbyists/activists who encourage it; the harmed are (and remain) the 5,913 companies and individuals who have certified claims against the government of the Republic of Cuba.

This legislation is about preserving opportunities for political contributions, advocate/lobbyist fees and media coverage. There seems to be an epidemic of courage of ignorance sweeping through certain offices in the nation’s capital….

The legislation is like a person being sick and doing everything possible to prolong the recovery. It’s stealing from one to make payment to another.

From a philosophical perspective, United States-based companies believe that they, not the United States government, should determine the credit worthiness of a customer. If management makes a mistake; that’s on management. The generally-accepted codicil to that position is when financing is provided to a United States-based company by a third-party financial institution who would have a fiduciary responsibility to access the ability of a customer’s customer to repay a debt; and if repayment of the obligation is insured (provided by) in any manner by an entity affiliated with the United States government. Representative Crawford’s legislation does envision United States-based companies accessing United States government financing/payment programs.

What should be done rather than legislation? Request that the Trump Administration engage in direct, consistent, high-level, resolution-date-imposed, negotiations to resolve the issue of the certified claims. The Trump Administration believes that it, through those who serve within it, specifically those with experience in the private sector, are natural negotiators. Unleash them.

Constitutionality

There are practitioners within the legal community who present that Representative Crawford's legislation is per se unconstitutional. See United States v. Int’l Bus. Machs. Corp., 517 U.S. 843, 846-48 (1996) “[t]he Export Clause states simply and directly: ‘No Tax or Duty shall be laid on Articles exported from any State.’ U.S. Const., Art. I, § 9, cl. 5. There have been occasions to interpret the language of the Export Clause, but cases have broadly exempted from federal taxation not only export goods, but also services and activities closely related to the export process . . . the Export Clause strictly prohibits any tax or duty, discriminatory or not, that falls on exports during the course of exportation.”

Mistaken Logic

Representative Crawford was quoted by the Arkansas Democrat-Gazette on 3 June 2017 offering "To my knowledge there's never been any attempt to ever address this problem before." That statement is false.

1) The Libertad Act of 1996 references the importance of and includes requirements for resolving the certified claims. 2) The Obama Administration placed a “high priority” upon seeking a resolution to the certified claims, although the effort was comical: two meetings in two years where a second meeting was not scheduled after the first meeting and a third meeting was not scheduled after the second meeting. 3) Representatives of United States companies with certified claims have visited the Republic of Cuba and met with representatives of the government of the Republic of Cuba; the Libertad Act provides a mechanism for private settlements- one of which has been in the public domain relating to telecommunications services. 4) There has been consideration of the value in obtaining the services of a mediator: http://www.cubatrade.org/blog/2016/12/1/zigs56x0gme3a9rqg7aecx9vf2gqgk?rq=feinberg

There is another reason “there's never been any attempt to ever address this problem before." The logic at the foundation of the attempt is misguided- it focuses upon “let’s do anything” as the basis for a solution rather than analyzing the rationality and practicality for delivering upon the premise.

There is commentary from an advocate that the legislation will “make it easier for Americans to sell food to private Cuban citizens…,” The Obama Administration authorized United States-based companies to export products and services directly to registered independent businesses (entities) in the Republic of Cuba; the government of the Republic of Cuba has not authorized that initiative despite efforts by officials of the Obama Administration, Members of Congress and from representatives of United States companies.

The lack of selling “food to private Cuban citizens” is not solely due to the “cash in advance” requirements of the TSREEA, it is a result of prohibitions by the government of the Republic of Cuba- which also extend to other products that the Obama Administration authorized for export (with payment terms) to registered independent businesses (entities) in the Republic of Cuba.

The published text of H.R. 525 states “there is no opportunity for United States agricultural businesses to trade directly with the Cuban people and there is no Cuban market; United States businesses have only one venue to trade with Cuba and that is through ALIMPORT, the state-owned and state-controlled entity.” That statement is correct because the government of the Republic of Cuba has refused to authorize United States-based companies to export directly to individuals and entities other than Alimport. The prohibition is not a result of United States statute or regulation; it’s a result of the policy of the government of the Republic of Cuba.

Historically, the United States business community privately favored the “cash-in-advance” provision of the TSREEA due to routine defaults (and/or rescheduling) on credit purchases by the government of the Republic of Cuba.

However, the United States business community does not support relieving the government of the Republic of Cuba of its obligation to the certified claimants. The legislation supported by Representatives Crawford and Curbelo creates an additional impediment to resolving an existing problem.

The legislation as currently written seems to provide an opportunity for the Republic of Cuba to access United States taxpayer-funded and taxpayer-guaranteed financing programs. The government of the Republic of Cuba has always viewed access to government export programs as the “holy grail” of their advocacy efforts. Why have Members of Congress accepted what has traditionally been anathema to them? Why has this enormously significant change in policy not been publicized by Representatives Crawford and Curbelo? Link to United States government programs:http://www.cubatrade.org/blog/2016/3/20/8iiwr41blj6mzfk8w921iadkexhmze?rq=government%20programs

Is this a realistic trajectory?

For 2017, the Republic of Cuba expects to import approximately US$1.8 billion to US$2 billion in food products and agricultural commodities compared to approximately US$1.8 billion in 2016 and 2015, US$2.5 billion in 2014; compared to approximately US$2.5 billion in 2008 and US$1.5 billion in 2007. The funds spent change with available foreign exchange and due to changes in commodity prices, with lower commodity prices still resulting in adequate quantities, but requiring lower expenditures.

There are those who view the Republic of Cuba through a prism which shows a country that they believe to exist, but does not.

How can a credible argument be made that the United States will supplant virtually all existing importing sources within one year? But, the logic gets even more spectacular….

According to the Arkansas Democrat-Gazette on 3 June 2017, “The original version of HR525, the Cuba Agricultural Exports Act, didn't include the fee when it was filed in January. In an interview Friday, Crawford said he plans to file an amended version of his legislation next week to reflect the change. The lawmaker estimates the 2-percent fee would generate roughly $30 million per year initially, rising to perhaps $60 million within five to seven years.”

For US$30 million to equal 2% of the value for all food product and agricultural commodity exports from the United States to the Republic of Cuba, the total value of those exports would need to be US$1.5 billion, which Representative Crawford was reported to believe would be the “within five to seven years.”

For US$60 million to equal 2% of the value for all food product and agricultural commodity exports from the United States to the Republic of Cuba, the total value of those exports would need to be US$3 billion, which Representative Crawford was reported to believe would be the “within five to seven years.”

How does any reputable economist evaluate the commercial, economic and political structures of the Republic of Cuba, as they exist today, and suggest that the country has a trajectory to increase imports of food products and agricultural commodities at an annual rate of 10% or more... and these would be imports only from the United States. What about the Republic of Cuba’s current sources of imports? Particularly, Vietnam which provides two years to make payment for rice? And, what about other countries where the Republic of Cuba, and the exporters, access government guarantees and access programs with provide for extended payment terms generally far exceeding commercial payment terms?

Has the government of the Republic of Cuba provided any public statement(s) as to whether they are prepared to increase purchases of food products and agricultural commodities from the United States if they are permitted to seek and then accept payment terms?

Has the government of the Republic of Cuba provided any public statement(s) as to what payment terms they would require as a condition to increase the value of purchases? 30-days, 60-days, 90-days, 120-days, 180-days, 360-days, 720-days?

Today, as has been the constant during the last five-to-ten years, extended payment terms for almost every product or service that is imported by Republic of Cuba government-operated companies, with the standard payment terms ranging from 180-days to 360-days.

Individuals and companies who work with and represent non-United States-based companies which export products and services to the Republic of Cuba posit that if United States-based companies provided 30-day repayment terms for food product and agricultural commodity exports, the result may be a 5% to 10% increase in the total value of exports to the Republic of Cuba; with primary beneficiaries exporters/distributors located in the State of Florida who can swiftly process and deliver food products (primarily for use in the hospitality sector) when inventories are unexpectedly depleted and replenishment from sources in Canada, Panama, and on the European Continent would result in further delays- even though the payment terms might be more advantageous.

If United States companies (with or without the support of United States financial institutions) were to provide payment terms of at minimum 180-days, but nearing or 360-days, then, perhaps, primarily agricultural commodity exports could be US$1 billion.

Until all that is considered by the government of the Republic of Cuba to be defined as “the embargo” is removed, likely market share for United States-based companies will be limited and the interest of United States-based companies will continue to be used as bait to entice interests in other countries.

However, the limitation will remain a limitation until the Republic of Cuba embraces fundamental commercial, economic and political changes which will increase public sector and private sector efficiencies and productiveness.

Thus far, however, none of the United States companies who have exported food products and agricultural commodities to the Republic of Cuba have publicly reported what payment terms they would offer if permitted to offer payment terms. And, United States financial institutions have not reported that they would provide financing for exports to the Republic of Cuba. Stating those positions would be helpful.

List Of Largest Certified Claimants: